When your flooring store customers are comparison shopping, and asking you if you can "meet or beat" a certain competitor’s price, how do you know whether you can do it?

How can you find the sweet spot between losing money and leaving money on the table?

What level of margin is too low for flooring sales? And how can you know?

Luckily, there are answers to these questions. Here are some essential things to do, to ensure you are selling flooring at the correct margin.

But first, a little background.

Years ago, my father owned a large, multi-location flooring business. His decades of experience working in the floor covering industry allowed him a pretty good general sense for costs and margins. However, sometimes his intuitive “guesstimates” would end up costing him. In a classic blunder, Dad would sometimes forget that Sales do not always equate to Profits, if you aren’t selling at the right margin.

If you’re not covering your costs adequately, that sale you just closed could actually be hurting you. This is why you should do all you can to vet out the profitability of a job every time you create a proposal. Knowing your margins and costs before finalizing the proposal helps you price things at the right margin, and will prevent the majority of unhappy “gotchas” down the road.

So what should your markup be?

Essential #1: Know Your Gross Profit Margins

Gross profit margins vs. simple markups

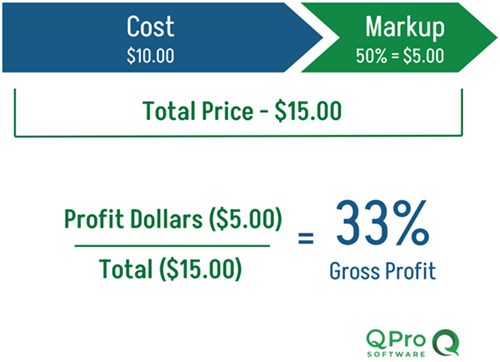

In our industry we talk about “gross margin percentages”, not markup percentages. Markup percentage is a percentage above cost. Gross Profit margin is a percentage of selling price. For example, if you have a product that costs $10 and you ‘mark it up’ 50%, you would sell it for $15. But when you calculate the gross profit margin on this same item, you would only be making 33% gross profit. That is because gross profit is calculated by dividing profit dollars by selling price (Profit Dollars/Selling Price). In our example that would be $5/$15 = 33%.

What should my flooring profit margins be?

Typical margins vary for the different kinds of flooring jobs. The industry average across all flooring dealers throughout the country is 37% (source: Bizminer). Commercial projects average below 30%, Builder/Apartment work averages between 30-35% and Residential remodel jobs should be above 40% as a general rule.

What costs are included in these industry average margins?

The direct costs to complete a job: Cost of Material and Cost of Labor to install the product combine for roughly 63% of the total sales revenue. 100% sales - 63% costs = 37% profit.

I am not saying that you should never take a job below 37%. I am saying that you should try to average above a 37% margin across all jobs (assuming a majority of residential remodel jobs).

Secondly, one of the most important things you need to do as a flooring dealer is consistently Job Cost.

Essential #2: Job Cost, Job Cost, Job Cost.

What is job costing and when should I do it?

Perhaps you’ve heard of the term, “job costing”. Basically, job costing is the method where you gather all of your costs of doing a job (materials, installation, freight, commissions, taxes, etc.), along with your shared overhead costs of running your business. Then you look at how much you are selling the job for, and how much of a profit you will be making. It sounds really complex, and time consuming, but once you have formulas and systems put in place, it can be a quick computation. There are business management software programs, like QPro flooring software, that can help you do this.

Job costing can be done before, during, and after the completion of a job.

Although most floor covering dealers understand the importance of job costing, relatively few do it consistently. Why?

One reason is that they may not have the technology to make the process simple and quick. They may not have the numbers and information they need to determine their costs. And it takes way too much time to compute all of that by hand.

Or, for some flooring dealers, they may have a system in place, but the numbers it gives them are not accurate. Another difficulty could be that many popular accounting, POS or business management software systems only allow you to job cost after-the-fact, when it’s too late to make a difference.

So when vetting software systems to help run your flooring business, try to find one that makes job costing quick, automatic, and easy. Make sure that the information you enter is accurate, so that the job costing will be accurate. And find a system that will job cost right on the sales order screen, as you are creating your proposal.

Having the information right there on the same page as the proposal means you don’t have to simply guess at flooring profit margins, and you don’t have to flip back and forth between screens. And you have the information you need to properly price the sale, BEFORE you finalize things.

The earlier, the better.

Here’s a scenario, showing how quick and helpful job costing can be. Say you want to see the difference between selling the job at a 40% margin or a 45% margin. If you have a software with job costing capabilities, you should be able to enter the margin and see the differences in price and profit.

Or let’s say you have a customer who is bargaining, and they tell you, “If you’ll do the entire job for $5500, it’s a deal.” You can type $5500 in as the total, and the job costing window should automatically adjust to show you what kind of profit margin you will make. Being able to play around with numbers and margins, right on the fly, before you close the sale, will protect you from unfortunate errors.

Essential #3: Set Up Retail Price Formulas

A third important thing to do, in order to ensure the right flooring business profit margin for your operation, is to set up Retail Price Formulas.

What are Retail Price Formulas and how can they help me?

Retail price formulas help give a suggested MSRP, based upon the cost inputs. The formulas can (and should) vary, depending upon products. For instance, your costs for hard surface freight and installation may be quite a bit higher than that for soft surface. Thus, your retail price formula percentage formulas should be different between the various categories.

Retail price formulas should factor in not only your costs of each product, but also standard labor rates for all of the different types of labor you might offer (for example, tile installation, carpet installation, stairs, tear out, carpet, LVT, hardwood, etc.) You should also note freight costs of different manufacturers by product type. And of course, like job costing, you should include a markup to cover just the general overhead costs of running your business.

While coming up with the correct equation may seem daunting, software can help with this. Similar to job costing, retail price formulas for selling flooring can often be generated by a good business management flooring software system. For instance, in QPro software, once costs are set up in the system, when a product is selected as a line item on a proposal, the suggested retail price will pop up as the default.

You can set different gross profit margins, based on costs, and you can set up an unlimited number of retail price formulas in your system.

Once the retail price formulas are set up, the rest is easy. When your customer is standing before you, waiting to hear the total price, you can either quickly pull it up (via software) or compute it (via calculator) and trust it is accurate. By having retail pricing formulas, you can see your costs and the suggested MSRP, and you don’t have to worry that you forgot to factor something important (like freight or overhead) into your price.

In Conclusion

Understanding your Gross Profit Margin, the importance of consistently Job Costing, and incorporating Retail Pricing Formulas are three powerful profitability hacks for a flooring professional. In an era when comparison shopping is made easier by online shopping, and the floor covering and home furnishings market is extremely competitive, it’s more important than ever to know where your margins should stay, and whether you are hitting that. With these important tools, flooring retailers can sleep better at night, knowing they are not losing money on a sale.

About the Author

Trent Ogden - CFO

Trent Ogden, CFO of QFloors/QPro, is a University of Utah alum with a bachelor’s in Accounting and an MBA. With over 25 years in the flooring industry, he is dedicated to helping flooring dealers of all sizes improve profitability through innovative technology, strategic financial controls, and expert training. His passion for accounting began while working in his father’s carpet store, where he saw firsthand the importance of accurate job costing and financial reporting. This experience fueled his commitment to developing software solutions that empower flooring businesses with the tools they need to succeed.